If LIBOR were to rise to 2.5% throughout that time, after that your brand-new rates of interest would certainly rise to 4.5% or 5.0%. The historic LIBOR price reveals that LIBOR raised in 2006 as well as 2007. It activated several home mortgage defaults that brought about the subprime home loan situation. That's a huge departure from the 2000s, when buyers were pressured into fundings that they could not afford. They then skipped en masse when their originally low home loan settlements unexpectedly expanded too expensive.

If rates rise, the price will certainly be greater; if prices drop, cost will certainly be reduced. In effect, the consumer has consented to take the interest rate risk. The minimum payment on a Choice ARM can leap dramatically if its unpaid major equilibrium hits the optimum limitation on adverse amortization https://www.feedsfloor.com/real-estate/4-tips-boost-your-business-builders-real-estate-agent (commonly 110% to 125% of the original lending quantity). If that happens, the next minimum month-to-month repayment will certainly go to a degree that would totally amortize the ARM over its staying term.

- Yet along with other consumer supporters, she acknowledges that reforms put in place considering that the housing accident have helped in reducing the dangers of adjustable-rate fundings by needing lenders to validate a borrower's repayment capacity.

- If you can manage it, any extra payment goes straight toward the concept.

- The authors stated loan providers were handing out 2 or three-year ARM products with low first payments that consumers can re-finance out of as soon as the price grows.

- The other means to protect that 3.33 rate of interest is to choose a 5/1 ARM home mortgage.

A former federal Check over here home mortgage banking auditor estimated these blunders developed at least US$ 10 billion in net overcharges to American home-owners. Such mistakes occurred when the related home mortgage servicer picked the incorrect index date, made use of an inaccurate margin, or disregarded interest rate adjustment caps. For example, if the borrower makes a minimal settlement of $1,000 and also the ARM has built up regular monthly passion of $1,500, $500 will certainly be added to the consumer's funding equilibrium. Moreover, the following month's interest-only repayment will certainly be determined using the new, higher primary equilibrium. When only two worths are offered, this shows that the initial adjustment cap as well as routine cap are the same. As an example, a 2/2/5 cap structure may often be composed simply 2/5.

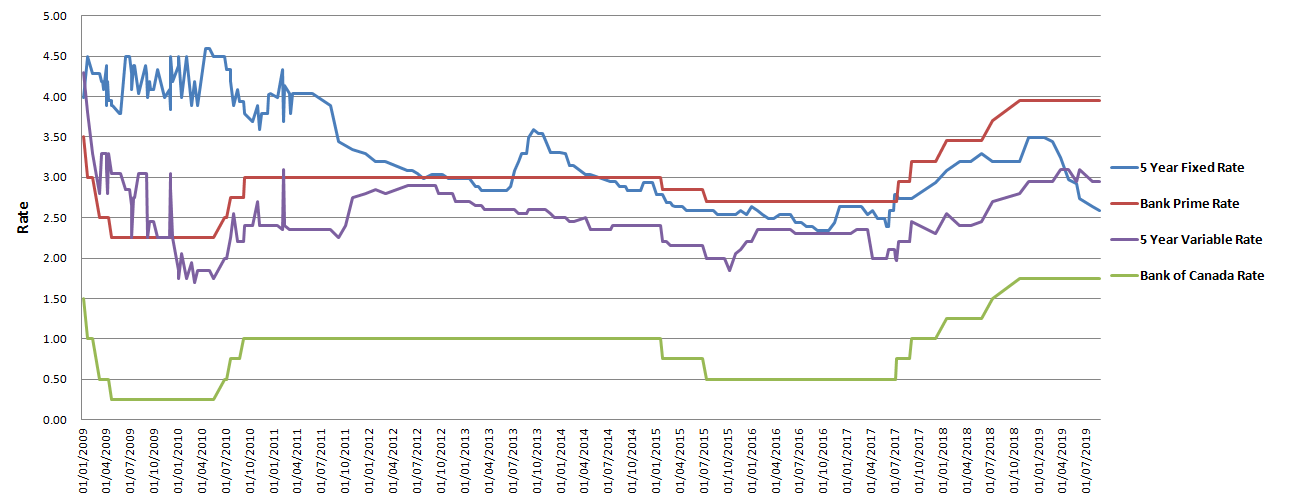

Today's Prices

ARMs that allow unfavorable amortization will usually have settlement modifications that happen less regularly than the rates of interest change. For example, the interest rate may be adjusted every month, yet the repayment quantity only once every 12 months. This is the length of time that the interest rate or loan period on an ARM is arranged to continue to be unmodified. The price is reset at the end of this period, as well as the month-to-month finance settlement is recalculated. Lazerson noted that whether a borrower selects a traditional fixed rate loan or ARM financing, with rate of interest climbing as well as inflation high, individuals ought to be conventional with their money. For Ronquillo, her clients with ARM finances are banking on reduced payments throughout the introductory period as well as re-financing from it before the rate matures.

Is It Worth Also A Little Risk To Save Simply 50 Basis Factors?

The 5/1 crossbreed ARM is an adjustable-rate mortgage with a preliminary five-year fixed interest rate, after which the rate of interest readjusts every year according to an index plus a margin. It could be extra listings on the marketplace, or probably simply fear that interest rates will certainly relocate even higher, but property buyers are revealing even more demand for mortgages. They are, nevertheless, turning a lot more to variable-rate mortgages, which offer lower prices. That provides an advantage as both prices and also home costs remain to climb up.

If those plans permit you to market the original home prior to the interest rate begins to vary, then the dangers of an ARM are fairly minimal. With eye-catching rate of interest offered, currently might be a great time to consider securing a reduced price throughout of your loan. Given that a new home loan is entailed, you'll require to experience a lot of the very same steps you took when getting your original mortgage. For example, you'll likely require to provide pay stubs, financial institution declarations, and also tax returns. Actual payments will vary based on your specific circumstance as well as existing price. There's a possibility your repayment might go down if rate of interest fall.

Payment-option ARMs have an integrated recalculation duration, typically every 5 years. There are a great deal of information to keep an eye on in selecting this type of funding, so caveat emptor. Charles Schwab Bank, SSB as well as Charles Schwab & Co., Inc. are separate however associated firms and subsidiaries of The Charles Schwab Corporation.

Home mortgage settlements swelled when the economic situation tanked, and numerous borrowers couldn't pay their new adjusted home mortgage or refinance their escape of it. For people who have a secure income yet don't expect it to increase considerably, a fixed-rate home loan makes more sense. Nevertheless, if you anticipate to see an increase in your earnings, selecting an ARM could save you from paying a great deal of passion over the long run. If rates of interest are high as well as expected to fall, an ARM will certainly make certain that you reach capitalize on the drop, as you're not locked into a certain price.

Re-financing An Arm

There might be a direct and legally specified web link to the hidden index, but where the loan provider supplies no certain link to the underlying market or index, the price can be altered at the lending institution's discretion. In lots of nations, flexible price home mortgages are the standard, as well as in such locations, might just be described as home loans. More buyers are selecting adjustable-rate mortgages, which use reduced regular monthly settlements originally, to emulate record-high home prices. Those reduced regular monthly settlements, as opposed to traditional 30-year fixed-rate home loans, are proving to be a solid appeal for customers looking to afford a residence in the white-hot housing market.

To put it simply, the rate of interest on the note specifically equals the index. Of the above indices, just the contract rate index is used straight. " The majority of my clients have actually been using ARMs," stated Abby Ronquillo, creator of NetRealty in Corona. Andrea Riquier reports https://thingsthatmakepeoplegoaww.com/how-kitchen-remodeling-can-increase-your-real-estate-value/ on real estate and financial from MarketWatch's New York newsroom. Karan Kaul, an Urban Institute scientist, called the current surge in the dimension of ARMs "paradoxical" for their resemblances to the bubble age, however stated that things are extremely different currently.